1.05 的 20 次 方

disgrace

Sep 18, 2025 · 5 min read

Table of Contents

Unveiling the Magnitude: Exploring 1.05 to the Power of 20

Calculating 1.05 to the power of 20 (1.05²⁰) might seem like a simple mathematical problem at first glance. However, understanding the implications of this calculation opens a window into the powerful concept of compound growth, a principle fundamental to finance, investment, and even population dynamics. This article delves into the calculation itself, explores the underlying mathematical principles, and examines its real-world applications, ensuring a comprehensive understanding for readers of all mathematical backgrounds.

Understanding Exponential Growth

Before diving into the specifics of 1.05²⁰, let's establish a foundational understanding of exponential growth. Exponential growth occurs when a quantity increases by a fixed percentage over a given period. This differs from linear growth, where the quantity increases by a fixed amount. In our case, 1.05 represents a 5% increase each period (think of it as a yearly growth rate of 5%). Raising 1.05 to the power of 20 signifies compounding this 5% growth over 20 periods. The larger the exponent, the more pronounced the effect of compounding becomes.

Calculating 1.05 to the Power of 20

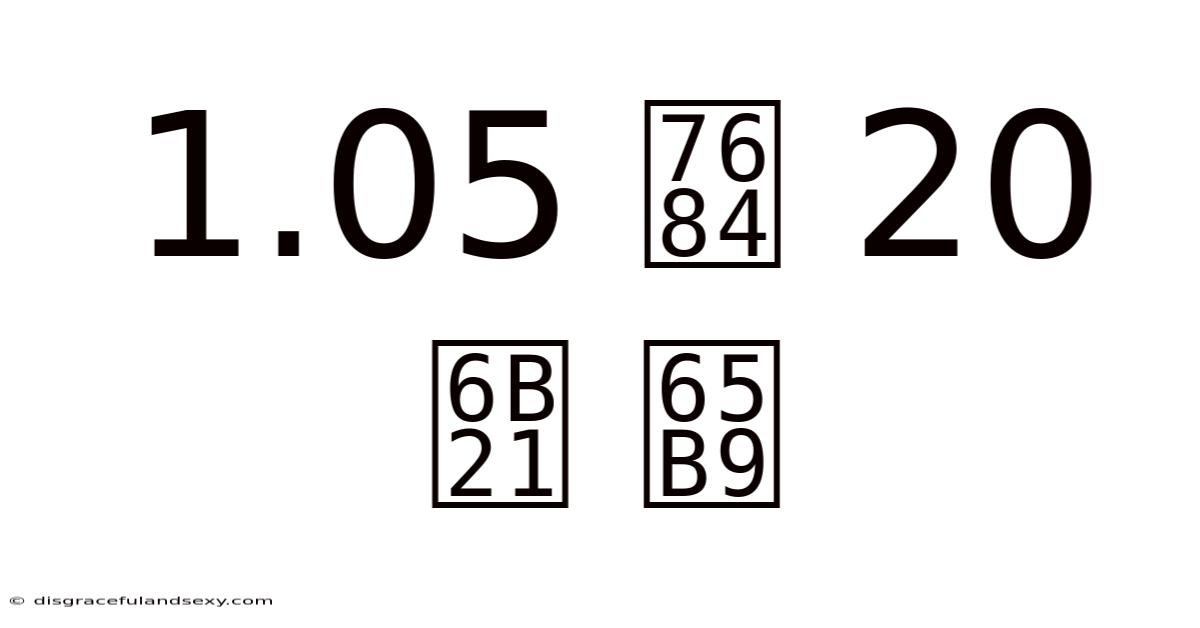

The most straightforward method for calculating 1.05²⁰ is using a calculator or a computer program with exponentiation capabilities. Simply input "1.05^20" or "1.05**20" (depending on your calculator or software), and the result will be approximately 2.6533. This means that if you invest an initial amount and it grows at a rate of 5% annually for 20 years, your investment will be approximately 2.65 times its original value.

Beyond the Calculator: Manual Calculation Methods

While using a calculator is the most practical approach, understanding alternative methods enhances your comprehension of the underlying mathematical concepts. Here are two such methods:

-

Logarithms: Logarithms allow us to solve exponential equations. To find the value of 1.05²⁰, we can use the following approach:

- Take the logarithm of both sides of the equation: log(1.05²⁰) = 20 * log(1.05)

- Use a logarithm table or calculator to find the logarithm of 1.05 (approximately 0.021189)

- Multiply the result by 20: 20 * 0.021189 ≈ 0.42378

- Find the antilog (inverse logarithm) of the result. This will give you the approximate value of 1.05²⁰. Using a calculator’s antilog function (often denoted as 10^x or e^x depending on the base of the logarithm used), we arrive at approximately 2.6533.

-

Binomial Theorem (Approximation): For smaller exponents, the binomial theorem can provide an approximate solution. The binomial theorem expands (a + b)ⁿ. In our case, we can rewrite 1.05 as (1 + 0.05). While the binomial theorem becomes cumbersome with an exponent as large as 20, it helps illustrate the compounding effect. The first few terms of the expansion are:

(1 + 0.05)²⁰ ≈ 1 + 20(0.05) + 190(0.05)² + ...

While this approximation is less accurate for larger exponents, it demonstrates how the initial investment (represented by 1) grows with each term representing the increasing impact of compounding.

Real-World Applications: The Power of Compound Growth

The concept of 1.05²⁰ and its result have significant implications in various real-world scenarios:

-

Investment Growth: This calculation is crucial for understanding long-term investment returns. A 5% annual return compounded over 20 years results in a significant increase in the initial investment. Understanding this principle helps in making informed investment decisions and setting realistic financial goals.

-

Population Growth: Population growth models often utilize exponential functions. If a population grows at a rate of 5% annually, this calculation can estimate the population size after 20 years. This information is crucial for urban planning, resource management, and predicting future societal needs.

-

Inflation: Inflation erodes the purchasing power of money over time. If the inflation rate is consistently 5%, this calculation demonstrates the decrease in the value of money over 20 years.

-

Debt Accumulation: Similarly, understanding exponential growth helps visualize how debt accumulates over time, especially with high-interest rates. The same principle applies, but with negative implications.

Beyond 5% and 20 Years: Generalizing the Formula

The principle illustrated by 1.05²⁰ can be generalized using the formula for compound interest:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment/amount

- P = the principal investment amount (initial amount)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested or borrowed for

This formula allows us to calculate the future value for any given principal amount, interest rate, compounding frequency, and time period. The calculation of 1.05²⁰ is a specific instance of this broader formula, where P = 1, r = 0.05, n = 1 (compounded annually), and t = 20.

Frequently Asked Questions (FAQs)

-

What if the interest is compounded more frequently than annually? Using the generalized formula above, you would adjust the 'n' value. For example, if interest is compounded monthly (n=12), the calculation would become 1.05/12 raised to the power of (12*20).

-

How does this relate to continuous compounding? Continuous compounding uses the formula A = Pe^(rt), where 'e' is the mathematical constant approximately equal to 2.71828. Continuous compounding results in slightly higher returns compared to annual or other finite compounding frequencies.

-

Can this be used for negative growth rates? Yes, if you have a negative growth rate (e.g., -0.05 representing a 5% decrease), the formula still applies. The result will be less than the initial amount.

Conclusion: Appreciating the Power of Compounding

Understanding the implications of 1.05²⁰ extends far beyond a simple mathematical calculation. It highlights the profound impact of compound growth, a principle governing many aspects of our lives, from personal finance and investments to population dynamics and economic models. By grasping the mathematical principles and applying the generalized formula, we can better predict and manage growth and decline in a variety of contexts. The seemingly small 5% annual increase, when compounded over 20 years, demonstrates the significant long-term effects of consistent growth, emphasizing the importance of long-term planning and strategic decision-making across various fields. The seemingly small increase of 5% annually, compounded over 20 years, results in a substantial increase, highlighting the importance of long-term planning and strategic decision-making. This understanding empowers individuals and organizations to make more informed choices and achieve their long-term goals more effectively.

Latest Posts

Related Post

Thank you for visiting our website which covers about 1.05 的 20 次 方 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.